India has had an unprecedented stretch of growth over the last four years, averaging over 8% per year. Inflation was relatively low in the early part of this period but has picked up recently, thanks to demand-side pressures. RBI began a monetary tightening cycle in late 2004 and has maintained this stance in its quarterly announcements. However since 2006 — along with increases in its benchmark rates, the bank has been using the cash reserve ratio as an additional instrument to control surging liquidity. This liquidity can be mainly attributed to high capital inflows, which have risen significantly over the past few quarters and are flowing into equity, corporate debt, and remittances from NRI’s (which seem quite unstoppable now).

By 2007, RBI has abandoned its currency management regime, which had resisted appreciation. The bank is now allowing the Indian rupee (INR) to more accurately reflect the balance of payments surplus. The currency has responded sharply to this tactic, appreciating by almost 10% over the last three months.

Growth, Despite Rising Interest Rates

As the Chart indicates below, the economy grew at 9.4% in fiscal 2006-2007 (April-March), spurred by a steady acceleration in the manufacturing sector. Industrial production grew at a double-digit pace over the last few quarters, a pattern that is inconsistent with the steady increase in benchmark interest rates over the same period. In fact, much of the growth momentum was provided by sectors such as construction and automobiles, which are recognized to be relatively sensitive to interest rates. This indicates the ineffectiveness of tightening monetary policy, which depended entirely on hiking interest rates. The banking system was able to offset the central bank's rate increases with the huge increases in liquidity from high capital inflows. Only when the bank implemented direct measures—the cash reserve ratio—to rein in liquidity in late 2006 did lending rates begin to increase.

As the Chart indicates below, the economy grew at 9.4% in fiscal 2006-2007 (April-March), spurred by a steady acceleration in the manufacturing sector. Industrial production grew at a double-digit pace over the last few quarters, a pattern that is inconsistent with the steady increase in benchmark interest rates over the same period. In fact, much of the growth momentum was provided by sectors such as construction and automobiles, which are recognized to be relatively sensitive to interest rates. This indicates the ineffectiveness of tightening monetary policy, which depended entirely on hiking interest rates. The banking system was able to offset the central bank's rate increases with the huge increases in liquidity from high capital inflows. Only when the bank implemented direct measures—the cash reserve ratio—to rein in liquidity in late 2006 did lending rates begin to increase.

The impact of these recent moves is only just beginning to become visible. Industrial production numbers for the initial months of the current fiscal year (April 2007-March 2008), while still showing high growth in the aggregate, clearly point to a slowdown in some critical sectors—automobiles and metal products, in particular. It also reflects long-term optimism about business conditions, even as the immediate future looks a little less bright than in 2006-2007. Meanwhile, the services sector, the largest and fastest growing segment of GDP, shows every sign of maintaining its momentum.

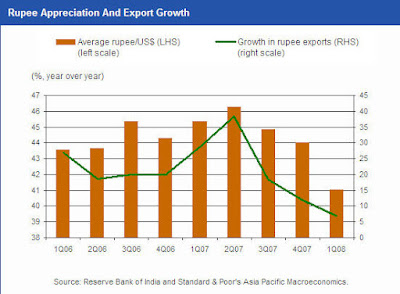

Yes - Export Growth is Slowing

The Chart below displays the rather dramatic impact on export growth (in rupee terms) as a result of the rupee's sharp appreciation over the past few months. This rate of growth is relevant in measuring the top-line impact of appreciation on exporters. Of course, businesses dependent upon imported material clearly benefit from this development, but the combined impact on exporters and domestic producers of importable goods is likely to significantly reduce aggregate demand, thereby contributing to the soft landing.

The reason the central bank abandoned its protection of an undervalued exchange rate was that it was becoming impossible to offset the expansion of money supply that resulted from foreign exchange reserve accumulation. The RBI realized that it cannot buy $$ at the same pace that $$ was flowing into the country. The impact of an appreciated rupee will no doubt linger for some time to come, while exporting and import-substituting businesses are forced to take immediate actions to improve productivity. Short of a massive crash in the equity markets that provokes a sustained exit of foreign investors, the rupee is unlikely to depreciate from current levels. The only question is whether it will have an unrestricted rise or if RBI will step in to attempt a more gradual and stable appreciation.

Time to Relax??

Based on the current dynamics of the Indian economy, GDP growth during 2007-2008 will drop from last year's 9.4% to around 8.5%. Given the likelihood of a neutral monetary stance over the next few quarters, growth during fiscal 2008-2009 should accelerate somewhat to the 8.5%-9% range. There is always a risk in the form of market turbulence and rising oil prices, both of which could prove to be destabilizing. At this point, however, their significance is not great enough to offset the strong fundamentals underlying the recent surge in growth.

There should be no surprises in inflation and it is also likely to hover around 5% during 2007-2008. Pressure on the rupee to appreciate continues under this scenario, as capital inflows more than offset a potential current account deficit. The risk here is from global market turbulence, which if severe enough, could even reverse the trend in the rupee. If this risk does not materialize, the rupee will appreciate in a managed way and everyone should be prepared for the Rupee to stay at the 39-40/1 mark with the $$ for a long time to come

No comments:

Post a Comment